WE EMPLOY THE VALUE APPROACH.

|

We emphasize the long-term and focus on the selection of individual common stocks using a bottom-up approach. We look for share-holder focused companies that participate in industries that have resilient characteristics. These companies are run by individuals who are capable, reputable and experienced. They produce high and consistent returns on capital with high profit margins, use their assets efficiently and employ debt financing sparingly. It is of vital importance that a target company have the financial strength required to withstand long periods of economic weakness.

Each investment is based on thorough research, offers safety of capital, and promises a satisfactory long-term rate of return. |

WE SEEK OUT SUPERIOR BUSINESSES THAT ARE TRADING BELOW THEIR INTRINSIC VALUE.

|

We cast a wide net by scouring developed and emerging markets for high-quality companies of any size. Our investment selections consist of companies available at low valuations relative to their normalized earning ability and book value.

|

WE DO OUR OWN RESEARCH. ONE COMPANY AT A TIME.

|

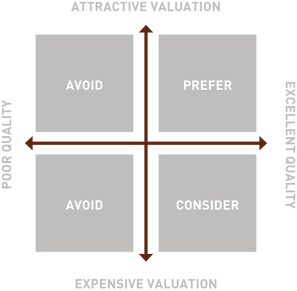

The objective of our research process is to discover excellent businesses selling at attractive valuations. We focus on companies that meet our standards of investment quality including a history of above average financial performance, a secure financial position, reputable management, and a growth opportunity in terms of sales, earnings, and share price.

Companies that meet all of our key quality criteria with the exception of valuation are placed on our consideration list. We monitor this list very closely and wait for the market to give us an opportunity to buy a target company at a favourable price. |